During the 2023 legislative session, Virginia Republicans introduced House Bill 472. This legislation outlined meaningful tax relief for Virginians struggling to make ends meet amid the Biden-Harris administration’s inflationary policies.

Among its provisions, this legislation included three key points of relief:

1) Doubling the standard deduction from $4,500 to $9,000 for single filers and from $9,000 to $18,000 for married filers. The increased deduction would last three years and help all Virginians keep more of their hard-earned income.

2) Providing a tax deduction of $12,000 for seniors aged 65+.

3) Permitting a deduction, up to $4,000, for contributions to a prepaid college savings account to help relieve families paying college tuition costs.

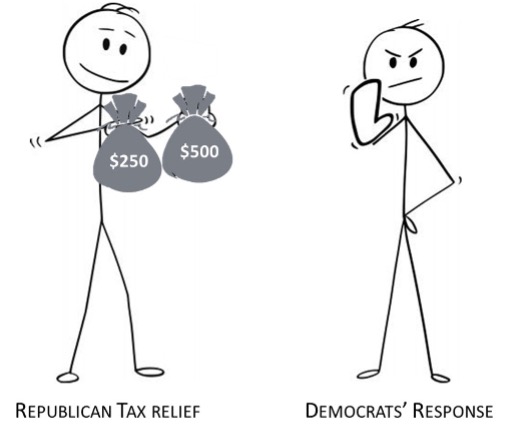

Consider a single filer making $50,000 annually. The difference between a $4,500 and a $9,000 deduction is the difference between retaining an additional $250 annually to help meet higher gas and food costs.

Or consider a married couple supporting a family on $80,000 per year. An $18,000 deduction means keeping an additional $500 that could be used on groceries, baby food, clothing, and other needs.

Despite the financial respite this would have given to Virginians, particularly for seniors living on a fixed income, Suhas Subramanyam chose the party line over his constituents and voted against the bill.

Subramanyam’s vote came despite clear evidence that inflation was eroding the value of the dollar and forcing Virginians to tighten their belts. Over the first year of the Biden-Harris administration, MONTHLY inflation rates reached as high as 7 percent. In January 2022, inflation stood at 7.5 percent and increased to over 9 percent later that year! Virginians desperately needed tax relief.

Meanwhile, college tuition costs have skyrocketed over the past few decades. In 2022, the average annual cost of tuition and fees ranged from over $28,000 at a public, four-year college to over $39,000 at a private, four-year college. Any tax deduction provides even modest relief to families trying to meet these astronomical costs.

Subramanyam wants to represent Virginians in the U.S. Congress, but he has failed to represent his constituents in the state legislature. His vote displays a blatant disregard for the financial concerns of working individuals and families throughout the 10th Congressional District.

Tax cuts passed during the Trump administration left more money in the hands of Virginians, but they are set to expire at the end of 2025. Subramanyam’s record indicates he would not extend these cuts.

With him in Congress, Americans should expect higher taxes in the near future.

NEWSLETTER SIGNUP

Subscribe to our newsletter! Get updates on all the latest news in Virginia.