by Arthur Purves

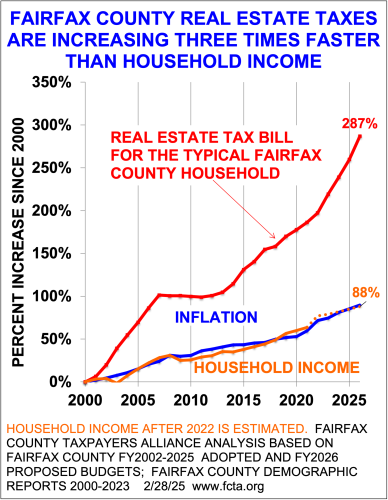

Since the mid-1980s, Fairfax County Board of Supervisors have increased real estate taxes at a rate three times higher than the household income. This trend will continue this year.

The average residential assessment increased this year by 6.2%. This means that the real estate tax for the average homeowner will rise 6.2% unless supervisors reduce the property tax rate.

The Board of Supervisors does not consider a 6.2% increase in tax to be enough. The board, under Chairman Jeff McKay’s leadership, instead of lowering the rate to offset an assessment increase is actually adding 1 1/2 cents to tax rate! The average homeowner will see their tax rate increase by 7.5%, the highest in the last ten years.

Taxes for the average homeowner will increase from $8 659 to $9 312 – a $653 rise.

McKay proposes a new meal tax in place of the rate increase of 1 1/2 cents. Even with the meals taxes, real estate taxes would still rise 6.2% on average due to increased assessments. Businesses pay already about 15 taxes. The meals tax for restaurants would bring the total to 16 taxes.

After the budget hearings, which will be held in the Government Center from Tuesday to Thursday, April 22-24.

Raising real estate taxes, pensions and medical insurance are the main drivers. The Board of Supervisors wants $300 million a year in new revenue to give 4% increases to 40,000 school and county employees. This is more than the inflation rate of 2.5%.

Pensions are also expensive. Pension contributions for non-uniformed workers are 34% of their salary. Most private-sector workers only have 401K plans, to which their employers contribute 6% of their salary.

How much do Fairfax County’s soaring property taxes cost?

- Between 2019 and 2024 there will be a 40-point decline in SAT scores , but school funding will increase by $600 millions.

- U.S. News and World Report has lowered the ranking of Thomas Jefferson High School for Science and Technology from 1 st down to 14 th.

- As of 12/31/23, there were 249 vacancies in a police force, despite the fact that it had a starting salary of $59,000, a salary average of $99,000 and a pension to which 58% of the salary was contributed by county.

- Housing that is unaffordable. Seniors are being forced to leave. College graduates can’t afford to live here. Subsidized housing cannot meet the demand; private construction is needed.

- Slowly approving businesses

- Since FY2000, there has been an increase of 304 staff and a 247% in funding for PublicAssistance & Employee Services.

- An increase of 23,000 and 59,000 respectively in SNAP (food Stamp) and Medicaid recipients since FY2020.

- Fairfax County is the 19 th county with a population over one million. It ranks next to Chicago in terms of domestic out-migration. Fairfax County’s net domestic migration in 2024 was a loss 8,000, while its net international migration was an increase of 16,000

- IRS data shows that since 2000, there has been a loss in adjusted gross income of $15 billion and 200,000 taxpayers.

- According to areadevelopment.com, the Washington, D.C., metro area is ranked 263 rd for economic performance out of 411 U.S. metro areas. The Capital Area Economic Forum was held at Vienna’s Westwood Country Club on December 4. The D.C. metro region is falling behind due to its inability to afford it, says the urgent message.

The county’s $300m budget deficit this year is primarily due to the four percent average pay raises, compared with inflation of 2.5% and the cost of medical and pension insurance.

The FCTA has made the following recommendations to make Fairfax County more affordable and to help the D.C. metro area be a leader in the U.S.

- The real estate tax rate could be limited to the growth rate of household income, resulting in lower increases while still covering $58 millions for rate increases on medical insurance and county pensions.

- Operating quality schools in a county that is business-friendly, where incomes of households increase faster than the inflation rate to fund raises above inflation.

- Instead of two salary increases a year (i.e. a Cost of Living Adjustment plus a Step Increase), streamline the salary increases so that they are based on performance, as is done in the private sector. Drop the COLA.

- Auditing school and county programs, and their staffing.

Arthur Purves, president of Fairfax County Taxpayers Alliance.

NEWSLETTER SIGNUP

Subscribe to our newsletter! Get updates on all the latest news in Virginia.